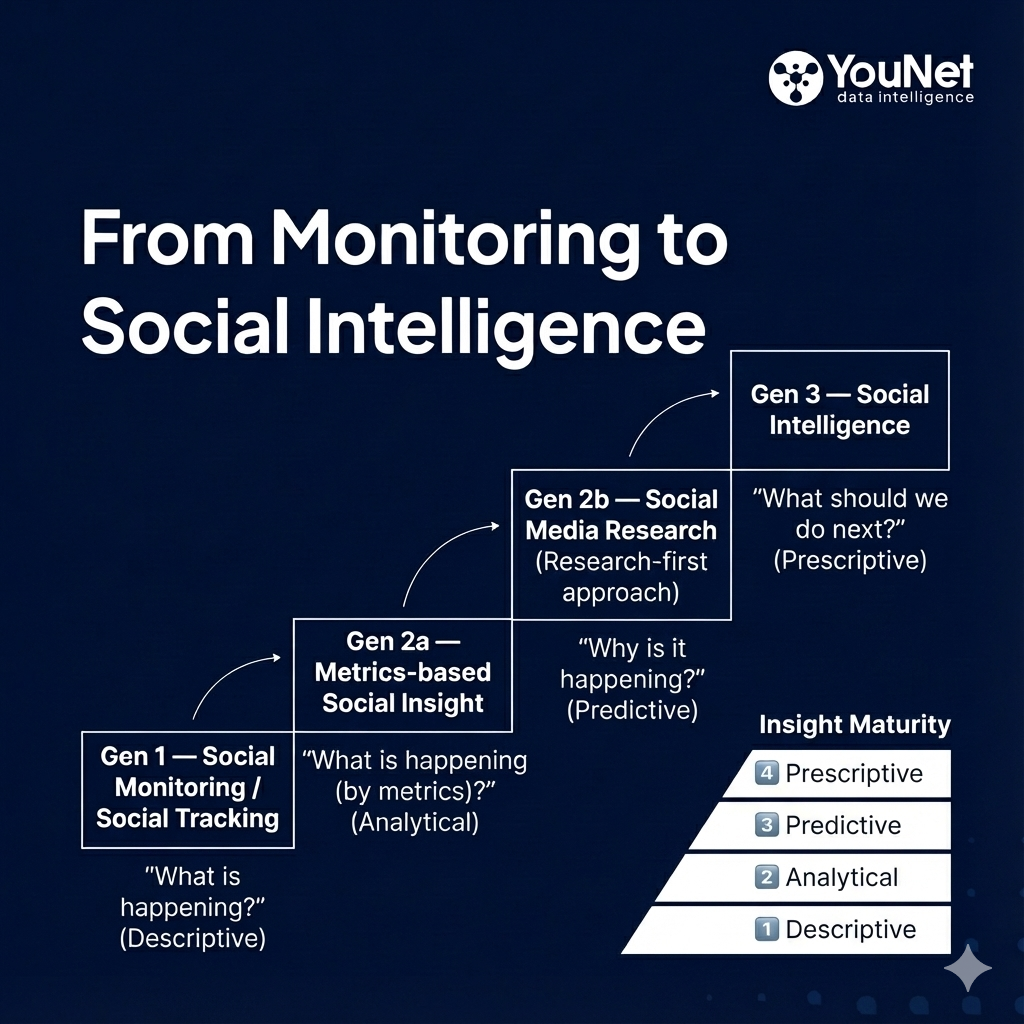

Social listening has been a staple of modern marketing for over a decade. Yet, what many organizations label as “social listening” today actually spans several generations of thinking, each representing a distinct level of insight maturity.

Understanding this evolution explains:

-

Why dashboards multiply while decisions remain difficult.

-

Why we “listen” more but understand less.

-

Why social listening alone cannot become social intelligence.

Gen 1: Social Monitoring / Social Tracking

The first generation focused on collecting and tracking public mentions across social platforms.

Typical outputs: * Real-time dashboards

-

Buzz volume

-

Sentiment

-

Share of Voice (SOV)

The structural limitation: Gen 1 primarily answers one question: “What is happening?” It records surface signals but fails to explain why events occur or dictate how to respond. Insight Maturity: Level 1 – Descriptive.

Gen 2: From Listening to Insight

As brands required deeper understanding, social listening diverged into two distinct paths.

Gen 2a: Metrics-based Social Insight This is the most common path adopted by many global platforms.

-

Characteristics: Dashboards are built around predefined metrics such as engagement, sentiment, and SOV. Analysis is inherently constrained by these available KPIs.

-

Core limitation: Business questions are often forced to fit the dashboard, rather than dashboards being designed around the business questions.

Insight Maturity: Level 2 – Metrics-Analytical (still descriptive in nature, lacking diagnostic depth).

Gen 2b: Social Media Research (A Research-first Approach) In this approach, social data is treated as formal research input rather than just a tracking signal. At YouNet Group, we adopted this methodology early on.

The research-driven process: 1. Business Question 2. Research Design (Hypotheses, analytical approach, and custom-designed metrics) 3. Data Collection 4. Analysis 5. Actionable Insight

In true research, metrics are not “off-the-shelf.” They are designed as tools to solve specific business problems. Insight Maturity: Level 3 – Diagnostic to Early Predictive.

Gen 3: Social Intelligence

In an increasingly complex market, social data in isolation is no longer sufficient. The next stage is Social Intelligence, where social insights are integrated into a broader decision-support system rather than serving as standalone reports.

What defines Gen 3:

-

Integration: Connecting social data with commerce, performance, and market context.

-

Shift in Focus: Moving from What and Why toward What next and What should we do.

-

Continuous System: Insights evolve from static reports into an ongoing intelligence engine.

Insight Maturity: Level 4 – Prescriptive.

The Role of Hybrid Intelligence

Between Social Media Research (Gen 2b) and full Social Intelligence (Gen 3), there is a practical transition phase: Hybrid Intelligence.

Hybrid Intelligence is not about collecting more data or merging more dashboards. It is about connecting insights from multiple domains – social, commerce, performance, and market context – to support real-world marketing decisions even when data is fragmented.

For many enterprises in Southeast Asia:

-

CRM/CDP systems are often incomplete.

-

Identity systems remain disjointed.

Waiting for a “perfect system” often leads to decision paralysis. Hybrid Intelligence is more pragmatic: it builds on social research and connects insights instead of waiting for full data unification. It focuses on priorities, trade-offs, and scenario building.

The question shifts from: “Which tool should we use next?” to “Which insights must we connect to make the next decision?”

The Insight Maturity Framework

-

Descriptive: Recording what happens.

-

Metrics-Analytical: Structuring patterns through predefined KPIs.

-

Diagnostic / Predictive: Understanding causes and forecasting trends.

-

Prescriptive: Informing strategic direction and action.

Conclusion: Social Listening Is Not the Destination

From this perspective, social listening is merely the starting point. Dashboards are tools, not answers. Competitive advantage is derived from the design of the insight system, not the volume of data.

What this means for Southeast Asia: In a region where social-first and commerce-driven growth are realities, but unified data architectures (CRM/CDP) are still emerging, the most effective roadmap is: Monitoring → Research → Hybrid Intelligence → Social Intelligence.

The critical question for leadership is no longer: “Which social listening tool do we use?” but rather: “At what level is our insight maturity – and does our current system help us evolve to the next level?”