“On social media, a person can straightforwardly express whether they accept a brand and its pricing – or not. But if you analyze discussions from, say, a million people in a month about electric vehicles, a business can grasp the collective intent of consumers,” said Mr. Nguyen Anh Hoa, CEO & Founder of YouNet Group.

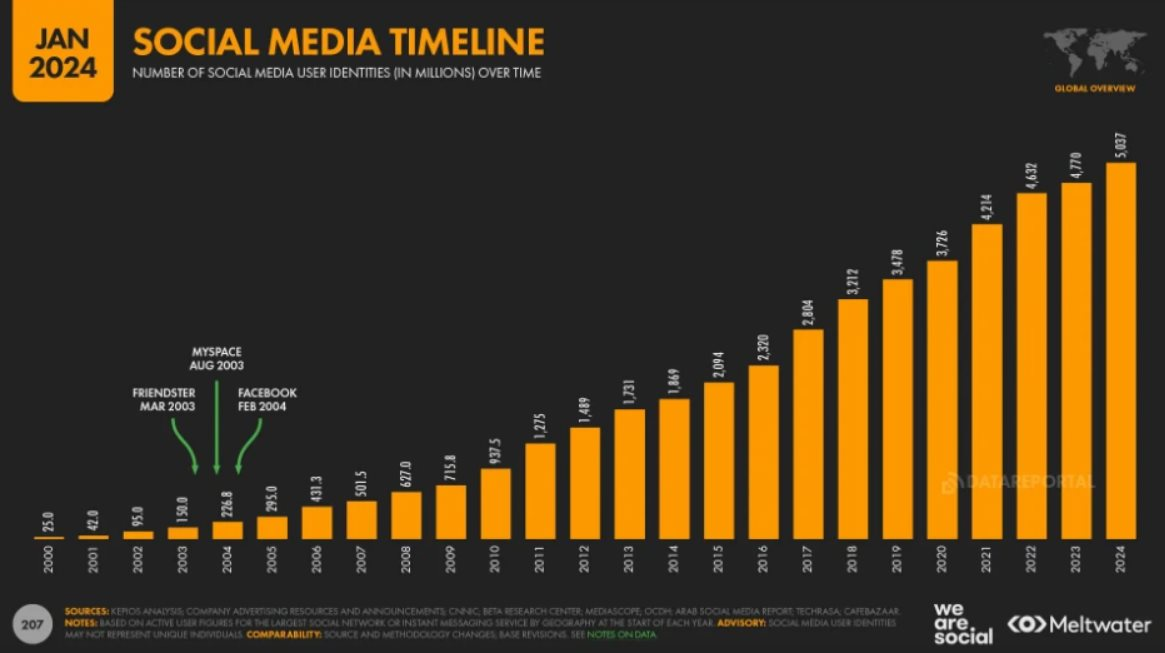

According to the Digital 2024 report by MeltWater and WeAreSocial released in February, 62.3% of the world’s 8.08 billion people are using social media, equivalent to 5.04 billion users. This figure is hardly surprising, given that 66% of the global population, 5.35 billion people are now internet users.

In Vietnam, there are 72.7 million social media users as of January 2024, accounting for 73.3% of the population.

Social media has completely transformed the lives of people around the globe, profoundly influencing every aspect of modern society. Businesses, too, have relied on social platforms to better listen to their customers. However, with the rise of big data and artificial intelligence (AI), they are now capable of much more.

“Most businesses still see social media merely as a monitoring tool to check who’s saying good or bad things about them, or to perform basic measurements of brand or campaign performance. They haven’t yet leveraged it to answer specific business questions,” noted Mr. Nguyen Anh Hoa, CEO & Founder of the social technology ecosystem YouNet Group. The approach that helps answer those business questions is known as social media research, market research based on social media data.

Global social media user growth over the years. Source: WeAreSocial.

Developing New Products Based on True Customer Insights from Social Media

A beer brand noticed that Gen Z’s behavior toward alcoholic beverages was completely different from other age groups. To understand this shift, the brand decided to explore the place where most Gen Z consumers spend their time – social media.

Through analyzing online discussions, the brand discovered that many young people liked to mix yogurt drinks or soda with soju or other alcoholic beverages. Combining this insight with traditional research methods, the brand developed a new product inspired by this trend – which was enthusiastically received by Gen Z. Not only did the product succeed, but it also helped rejuvenate the brand’s image and strengthened its connection with younger consumers.

“Social Listening can answer questions across four key dimensions: category, brand, campaign, and users. For instance, when it comes to the category aspect, if a Vietnamese electric vehicle brand wants to expand to the Thai market, it must first analyze how many people have discussed ‘electric cars’ in the past month or year, which brands are most mentioned, what the positive and negative sentiments are, and how interest in the category is trending,” explained Mr. Nguyen Anh Hoa.

Traditionally, companies have relied on market research to collect business intelligence. Using the conventional method, researchers define their research problem, identify target customers, and conduct surveys. Globally, large market research firms usually take on this work thanks to their big budgets and deep expertise.

“That’s the traditional approach,” Mr. Hoa said. “But now there’s another option – online data–driven market research, including data from social media platforms. This method has advantages in both cost and execution speed. For businesses looking to go global, this approach provides an additional perspective – and together, the two methods yield complementary insights.”

He continued: “Take, for example, a Chinese electric vehicle company planning to enter Vietnam. By analyzing one million social media conversations about electric cars in a month, the company can gauge consumer sentiment — such as how many people mention the brand, what aspects they respond positively or negatively to, whether they are open to Chinese brands, and what price range they find acceptable.”

Mr. Hoa noted that offline surveys are limited, they can’t include too many questions and take considerable time to complete. In contrast, social media offers vast, readily available data that can be collected quickly and at a lower cost, while maintaining comparable accuracy.

He emphasized that the two research methods should complement each other rather than replace one another. However, he predicted that a growing share of market research budgets will shift toward social media analysis – partly because of the rapid rise of e-commerce.

“Tỷ trọng bán hàng online trên tổng bán lẻ của Việt Nam hiện nay chiếm khoảng 11%, tốc độ phát triển khoảng 35% mỗi năm. Trong khi đó, tốc độ phát triển chung của thị trường bán lẻ chỉ có 12%. Theo dự đoán của tôi, tới năm 2030, tỷ trọng bán hàng online sẽ chiếm 35% tổng thị trường bán lẻ.

“Currently, online sales account for about 11% of Vietnam’s total retail market, with an annual growth rate of around 35%, compared to only 12% growth in the overall retail sector. I predict that by 2030, online sales will make up 35% of total retail. As the online market grows stronger, budgets for digital and social media research will continue to increase, though it will never completely replace traditional research,” Mr. Hoa concluded.

Selling “trend-driven” products abroad from Vietnam

With the explosive growth of e-commerce, especially cross-border e-commerce, businesses are now standing before a “golden opportunity” for limitless expansion. The closest and most accessible market to Vietnam is Southeast Asia, home to over 600 million people and one of the world’s fastest-growing regions, with an average annual economic growth rate of around 6%.

“With such an attractive market, why not broaden our horizons a bit, right? One of the key characteristics of Southeast Asia is its highly active social media users,” noted Mr. Nguyen Anh Hoa.

With the advancement of social media and e-commerce, Mr. Hoa believes more Vietnamese businesses will soon embrace the global dream. As language processing becomes easier thanks to AI, conducting social listening in international markets is now more accessible than ever.

“Following our research, we’re targeting around 100 leading companies to introduce our social media–based market research service designed to help them go global,” revealed the CEO of YouNet Group.

In addition to social media data, YouNet also analyzes e-commerce data to provide a more holistic market perspective. By combining these two data sources, businesses can identify the most effective market entry strategies – from setting optimal price points and marketing plans to choosing the right sales channels and KOLs.

“By sitting in Vietnam and monitoring overseas markets, businesses can instantly catch trends the moment they emerge elsewhere. Conversely, foreign trends can also flow into our domestic market. Sometimes, a product that may not gain traction in Vietnam could become a hit in Thailand or Indonesia,” Mr. Hoa added.

In conclusion, Mr. Hoa emphasized that companies seeking to expand internationally should begin with online channels – a faster, more efficient, and cost-effective approach. Conducting thorough market research before entry is absolutely essential.

“Bringing your product to a new market without understanding it is like sending troops into battle without any intelligence – it’s nearly impossible to win,” he remarked.