Discussions in the banking sector during Q2/2025 have been lively not only due to the volume of conversations but also because of the participation of high-quality users (Qualified Users).

Through the lens of the CFQU Index (Content From Qualified Users), YouNet Media analyzes and identifies which banks attract the most attention from high-quality users, as well as which content and platforms engage these users the most. Explore the data to see which banking brands hold the advantage with high-quality users!

Disclaimer (*): The analysis in this article is based on data collected from 13 banking brands, including Techcombank, TPBank, VietinBank, MBBank, Vietcombank, MSB, VIB, VPBank, BIDV, Sacombank, ACB, Vikki, and CIMB.

1. Banking Sector Discussion Share Through the Lens of the CFQU Index

The Vietnamese banking sector entered Q2/2025 facing increasingly fierce competition in brand image and market positioning, particularly as financial institutions no longer play merely the role of traditional service providers. They are actively positioning themselves as trusted companions who understand customers, engaging deeply with popular culture, art, and the modern digital lifestyle. This transformation is especially evident as discussions around banking brands increasingly extend into creative fields, generating strong inspiration and widespread resonance within the community.

To help banking brands gather more accurate and valuable insights, filter out “noise,” and focus on genuine voices from high-quality users, YouNet Media, in collaboration with YouNet Group, developed a new set of indices: Qualified Users (QU) and Content From Qualified Users (CFQU).

The CFQU index measures the total volume of public discussion content (posts, comments, shares) generated by Qualified Users – users who show no signs of abnormal behavior in frequency, volume, or duplicate content. CFQU thus acts as a filter for both content and high-quality users, clearly highlighting the true resonance and value that a banking brand creates in the digital space.

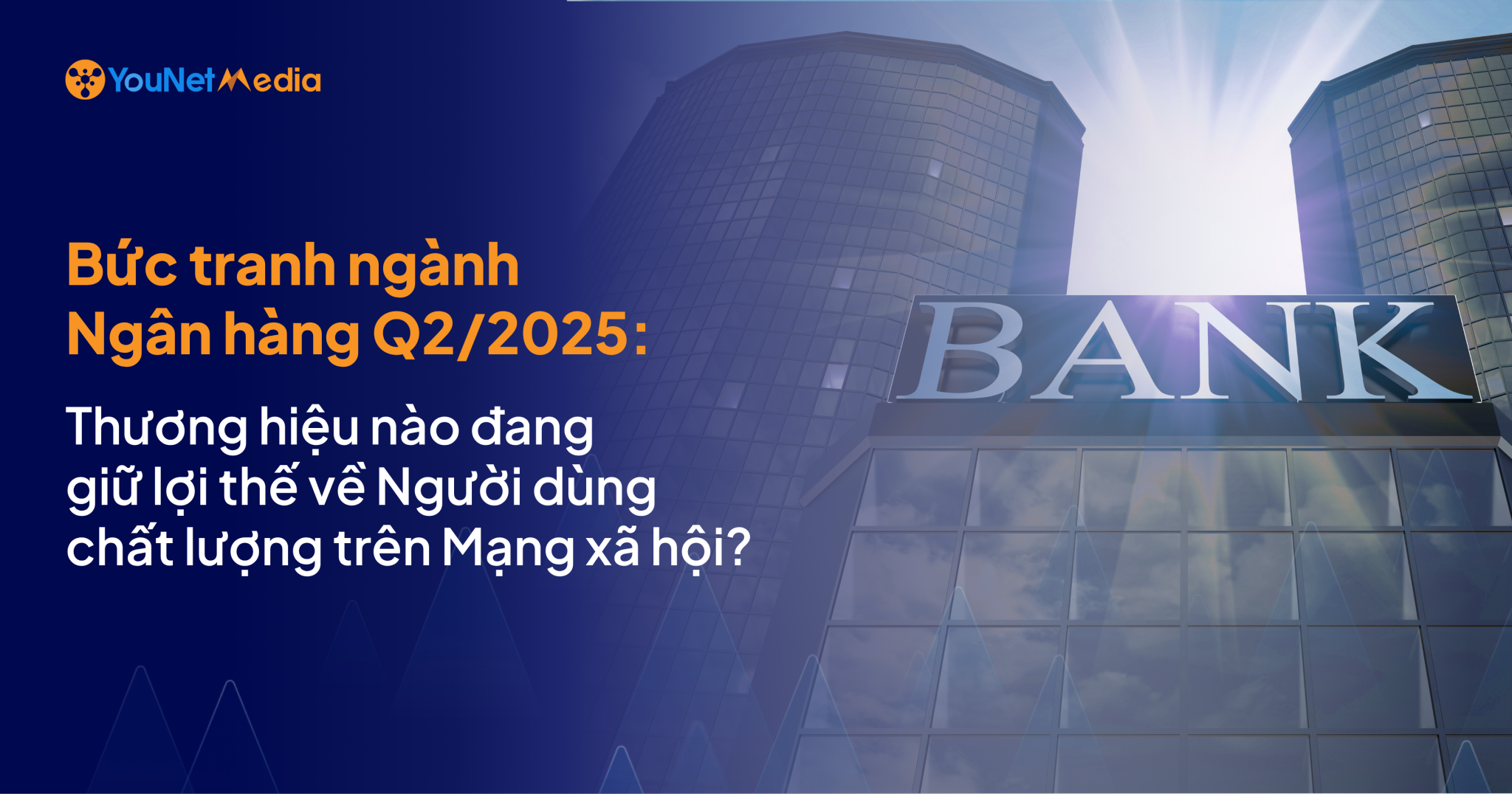

According to YouNet Media statistics, in Q2/2025 alone, the banking sector attracted 699,018 users generating over 1.9 million discussions related to brands. However, when applying the CFQU index, only 468,575 truly high-quality users remained, creating 743,619 discussions. These figures reveal a significant gap between surface-level buzz and the real value of discussions, underscoring the importance of evaluating brand market share based on quality metrics rather than simply counting total buzz.

In Q2/2025, the sector recorded a discussion rate from high-quality users (ROCFQU) of 37.3%, with a high-quality user rate (ROQU) reaching 67.05% – while not yet meeting the expected potential of the industry, these rates are still significantly higher compared to other sectors. For example, in the dairy industry, these two indices reached only about 8.3% and 26.5%, according to YouNet Group data (measurement period: 07/2023 – 06/2024).

From this data, it is evident that the banking sector currently demonstrates vibrant discussion activity along with a superior volume of high-quality users, reflecting strong appeal to potential customers who understand real value. This trend indicates that customers increasingly prioritize brands focused on sustainable development and long-term value.

Notably, after applying the CFQU index, it is clear that the Top 5 banking brands account for 80% of discussion share (CFQU) and high-quality users (QU), including VPBank, Techcombank, TPBank, VIB, and VietinBank. These banks are also prominently associated with sponsorship of major gameshows and music-entertainment events, such as Show – Anh Trai Vuot Ngan Chong Gai, Show – Em Xinh Say Hi, and Dai Nhac Hoi VPBank K-Star Spark 2025.

So how do banking brands rank in terms of discussion volume after applying the CFQU index?

- VPBank maintains its leading position with 285,680 discussions, accounting for 38.42% of the discussion share from high-quality users, while also having the largest number of Qualified Users (174,363 users – 37.21%).

- Techcombank ranks second with 120,034 discussions (16.14%) from 72,992 Qualified Users (15.58%).

- TPBank comes in third with 87,677 discussions (11.79%), followed by VIB with 51,803 discussions (6.97%) and VietinBank with 50,751 discussions (6.82%).

- The remaining banks account for over 20% of the discussion volume and high-quality users.

Notably, when comparing rankings before applying the CFQU index, the top 5 banks remain unchanged, indicating that the leading banks are strong not only in brand coverage but also in genuine appeal to the user community. Looking more closely at each bank’s market share, there is a clear differentiation, particularly highlighting VPBank’s superiority over competitors.

Applying the CFQU index provides a more realistic and in-depth view of banking brand strength on social media. It allows banks to measure the true reach within the community, while also guiding brand-building strategies – shifting the focus from quantity to quality and emphasizing real value in each interaction with customers.

Moreover, the high discussion volume among the top 5 banks demonstrates intense competition, pushing brands to continuously innovate and ensure every piece of content resonates meaningfully, connecting and inspiring the community.

2. Which banking brands lead in the number of high-quality users participating in discussions?

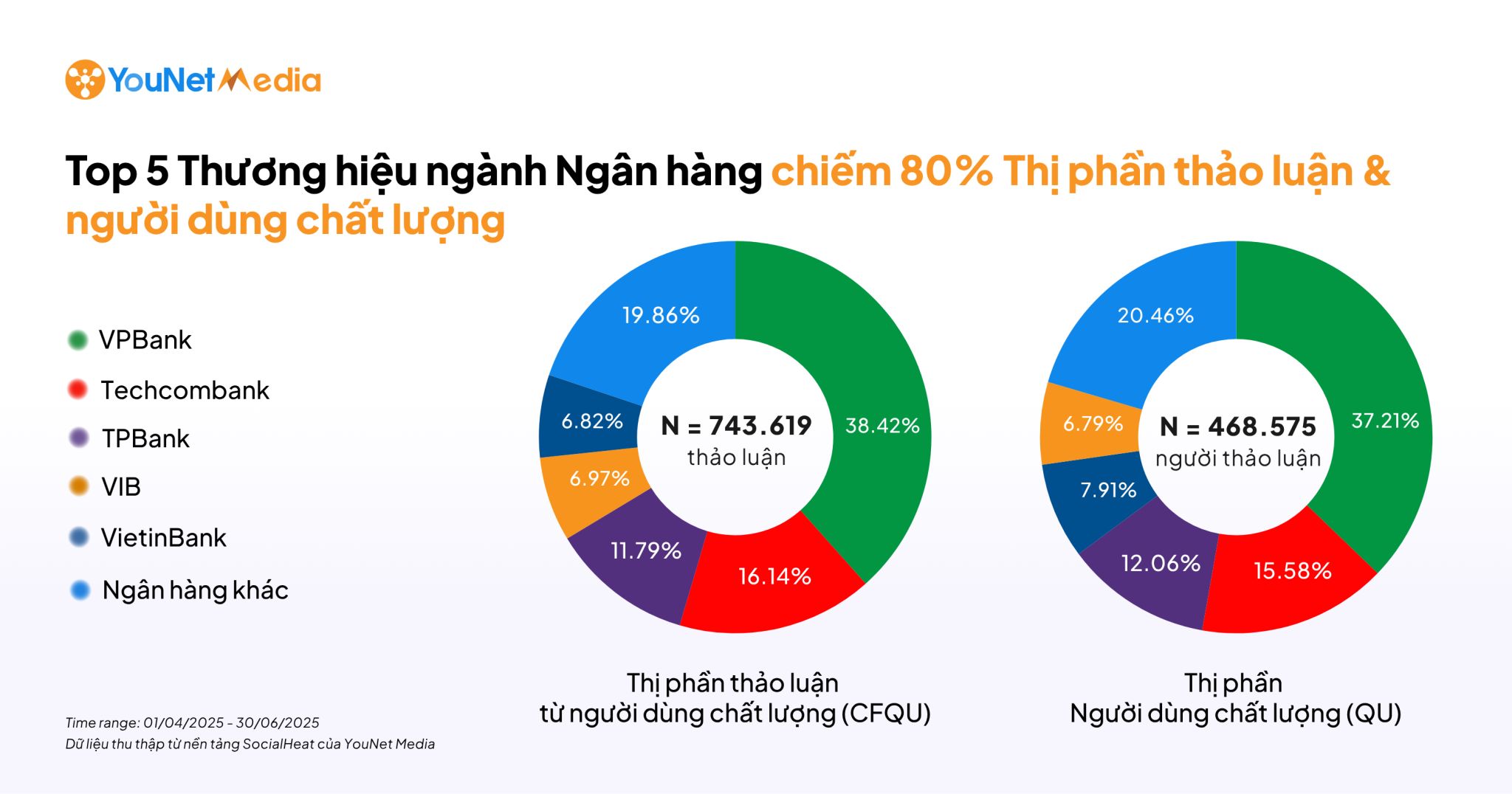

The chart below highlights the number of high-quality users (Qualified Users) and illustrates the positioning of each bank. It is based on three core factors: Market Share of Qualified Users (QU), rate of high-quality users (ROQU), and the size of this user group (represented by bubble radius).

Disclaimer (*): The names displayed in the chart include only the top 5 banks by QU market share; other banks have been anonymized.

The two median lines – QU market share (3.61%) and ROQU (65.8%) – divide the space into four distinct quadrants:

- Top-right (Star Quadrant): Large discussion volume, high-quality users (absolute advantage zone).

- Top-left: Small discussion volume, high-quality users (banks with potential for rapid growth if scale is expanded).

- Bottom-right: Large discussion volume, but quality users below competitive threshold (needs improvement in interaction depth).

- Bottom-left: Small discussion volume and low-quality users (risk of shrinking market share).

Analyzing the chart of Qualified Users (QU) in the banking sector reflects not only the scale of discussions but also strategies for maintaining sustainable engagement.

With the median lines at QU market share (3.61%) and ROQU (65.8%), the competitive space is divided into four zones. Banks in the Star Quadrant (top-right) hold a dual advantage: large discussion volume and high proportion of quality users, while also leading trends.

VPBank, Techcombank, and TPBank stand out in this group by effectively leveraging three core factors: large-scale activities and events, engaging entertainment content, and practical customer incentives.

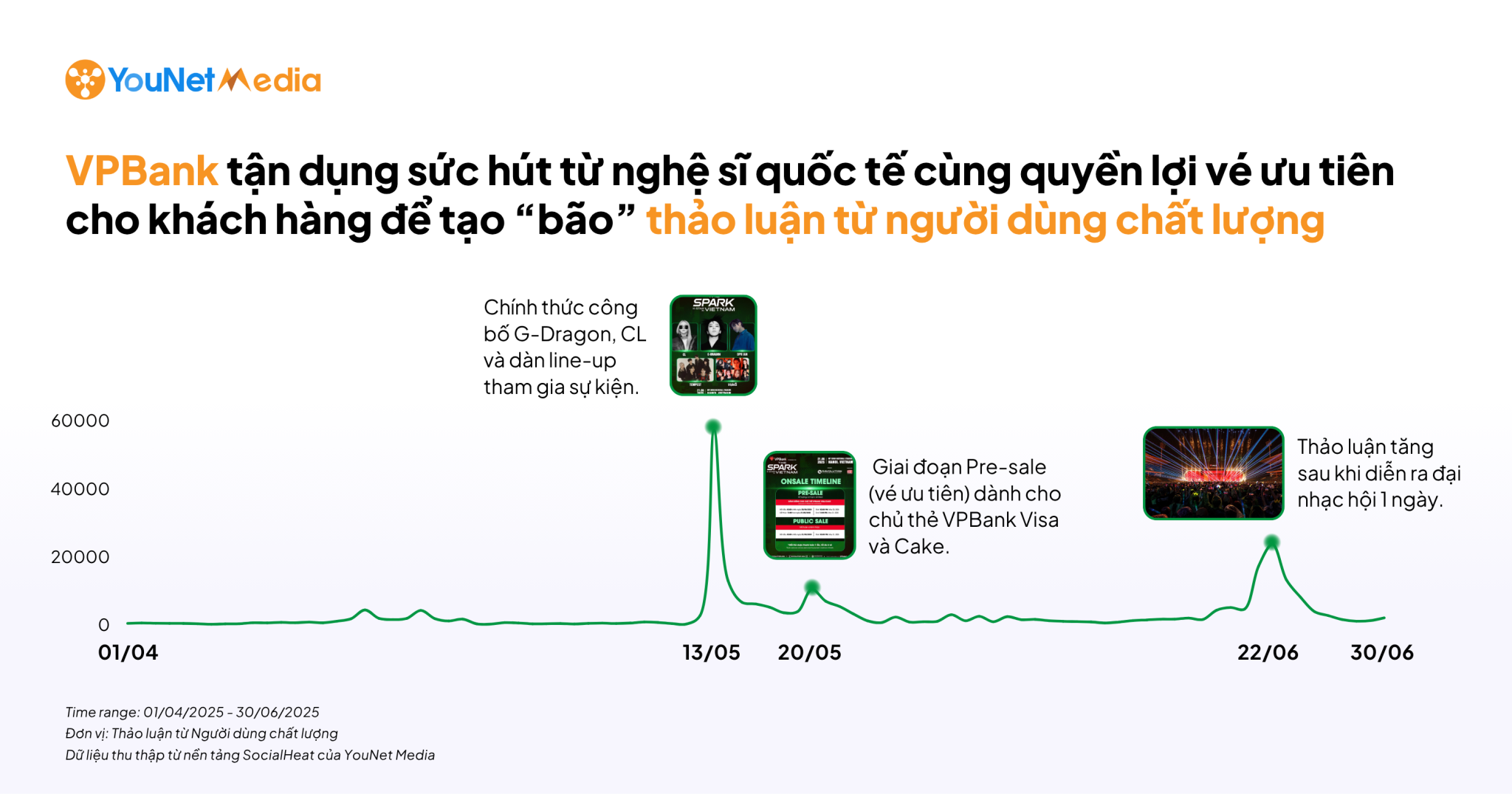

Specifically, VPBank (VPBank K-Star Spark In Vietnam) harnessed the appeal of international artists along with priority benefits, generating a discussion “buzz” far exceeding other brands during the event period.

Meanwhile, Techcombank (with the concert Anh Trai Vuot Ngan Chong Gai and the program Tan Binh Toan Nang) maintained a stable discussion volume over three consecutive months through a multi-channel activity mix (livestreams on Facebook & YouTube fanpages).

TPBank (Em Xinh Say Hi) demonstrated consistent discussion levels by turning each episode of the entertainment show into a social media “hotspot,” amplified by content shared directly by employees.

A common characteristic among these three leading banks is their ability to turn events into communication catalysts, extending the effect through promotions and real interactions. This approach not only increases QU market share but also strengthens brand positioning in customers’ minds.

In a highly competitive environment, top banking brands cannot rely solely on the scale of communication; they must create tangible value, connect emotionally, and enhance user experiences, thereby building a distinct quality advantage.

Success Formula for Banks: Scale Must Go Hand-in-Hand with Quality

According to the analysis of the chart showing the distribution of top banks by number of quality users on social media, we can observe:

- VPBank, TPBank, and VietinBank have achieved a good balance between quality user scale and content conversion efficiency.

- Techcombank and VIB, while having a solid scale foundation, need to prioritize increasing their ROQU (ratio of quality users) to convert potential into genuine competitive advantage.

- Some other banks have high-quality users but smaller scale, so they should focus on growing their user base.

The key takeaway is that pursuing scale or quality alone is insufficient. Only brands that combine a large community with high-quality interactions can maintain a sustainable position and exert strong influence in the digital market.

Any strategy for bank brand development in the digital era should focus on enhancing user experience and motivating quality users to actively generate positive content. This is considered the key to conquering the market sustainably and increasing long-term value.

It is evident that the success formula for banking brands in the digital space is not only about balancing scale and quality but also requires understanding and proactively leveraging the drivers that encourage community engagement.

So, what are the core factors that enable banks to consistently generate discussion peaks and maintain brand buzz in the market? Let’s analyze this in the next section with YouNet Media.

3. Which Platforms and Content Types Generate the Most Quality User Discussions in the Banking Industry?

According to the data, the “heat” of the banking industry on social media reached over 1.3 million discussions on Facebook in Q2/2025. However, only about one-third (431,616 discussions) came from truly quality users – those with higher conversion potential. This highlights that the key challenge no longer lies in “amplifying volume” but in elevating interaction quality.

Quarterly data shows that the buzz around the banking sector remains concentrated on major social platforms, with around 1.3 million discussions on Facebook, 448K from TikTok, and 81K from YouTube. Yet, when analyzing user quality – the critical factor determining conversion potential – notable differences emerge.

On Facebook, only about 431,616 discussions (roughly one-third) came from high-quality users – those more likely to convert into tangible financial actions. Meanwhile, TikTok generated 240,946 quality discussions, accounting for 53.71%, showing relatively stable engagement with potential customers.

Notably, YouTube, despite contributing only 81K discussions (significantly less than Facebook and TikTok), had 71,054 from quality users, equivalent to an outstanding 87.35%. This remarkable rate suggests that although discussion volume remains modest, YouTube has the highest density of quality users among all platforms.

Most banks have yet to fully leverage YouTube as a strategic content channel – even though it represents a high-conversion-value space. With nearly 90% of its discussions coming from quality users, YouTube can serve as a strong foundation for in-depth content campaigns, such as financial advisory videos, investment knowledge sharing, or brand storytelling, helping banks reach the right audience segments more efficiently.

The gap between discussion volume and quality serves as a crucial indicator for resource allocation. While Facebook and TikTok continue to drive mass awareness, YouTube is emerging as the go-to channel for high-quality, high-intent audiences. In upcoming multi-channel content strategies, increasing presence on YouTube will allow banks to both expand their reach and optimize conversion rates.

In terms of content types, entertainment programs remain the “magnet” attracting discussions. Vie Channel continues to lead with brand collaboration programs like Em Xinh Say Hi (TPBank) and Anh Trai Say Hi (VIB), maintaining widespread discussion flows. Particularly, VPBank stands out as a “trendsetter,” leveraging strategic partnerships (K-pop idols, football, minigames, TV shows) while also building its own branded events — constantly refreshing messaging to sustain attention and engagement.

Although discussion quality metrics vary significantly across platforms, entertainment content remains a strong catalyst. However, the choice of platform and investment strategy in content directly determine how effectively banks reach their target audiences.

To create impactful “buzz waves” on social media, banks must not only maintain the effectiveness of entertainment-based campaigns but also combine them with the right platform choices and content strategies that drive conversion. This requires a balance between reach and depth, ensuring that brands not only achieve wide visibility but also build meaningful connections and attract quality user communities.

4. Conclusion

Amid the accelerating wave of digital transformation, banks have transcended the boundaries of traditional financial services, actively integrating entertainment and culture throughout the entire customer journey – from engagement to retention. This shift not only broadens brand influence but also fosters multi-dimensional, emotionally connected relationships with modern consumers.

Practically speaking, Q2/2025 data reflects a clear transformation in communication strategies: instead of focusing on volume-based metrics (including artificial or low-quality discussions), leading banks are prioritizing platforms and content programs that can convert engagement into tangible, sustainable brand value.

Today, the driving force behind discussion “peaks” is no longer just marketing budgets or media coverage, but rather agility in trend adaptation, creativity in collaboration, and a user experience–centric mindset. Facing increasing competition, this provides valuable guidance for banks to redefine their communication strategies — shifting from “growth in quantity” to “growth in quality,” emphasizing authentic experiences and meaningful engagement.

Ultimately, the key to sustainable success lies not only in multi-channel presence but also in the ability to create impactful, long-term experiences that resonate with users at every digital touchpoint.

YouNet Media, supported by YouNet Group, proudly stands as the first organization in Vietnam to develop and apply the Content From Qualified Users (CFQU) index in monitoring and measurement systems. CFQU enables precise identification of genuine content, effectively filtering out repetitive, ad-driven, or inauthentic posts – delivering the most accurate reflection of communication performance.

As a result, every data point and analysis truly represents the authentic voice and organic influence of real users – empowering businesses to plan strategies and make decisions based on clean, reliable data.