In the first half of 2025, the Refrigerator category across Shopee, Lazada, and Tiki recorded a total Gross Merchandise Value (GMV) nearly doubling compared to the same period last year. Despite the inherent challenges of the category, the refrigerator market is showing strong signs of recovery and growth on E-commerce platforms. Among the key highlights, AQUA (Haier) stands out as the “bright spot,” attracting younger consumers to the category through its compact-capacity, affordable refrigerators.

The Sustainable Growth Ranking on E-commerce by YouNet ECI not only reflects sales performance but also reveals each brand’s operational health. The evaluation framework is based on four key indicators, analyzed from data collected across Shopee, Lazada, and Tiki:

- Performance Index: Measures market share within the E-commerce refrigerator category and the brand’s revenue growth rate on each platform.

- Shop Index: Assesses the number and quality of the brand’s official and authorized stores across E-commerce platforms.

- Variant Index: Evaluates the diversity and revenue contribution of the brand’s product lines.

- Price Range Index: Examines the diversity and revenue performance across the brand’s different pricing segments.

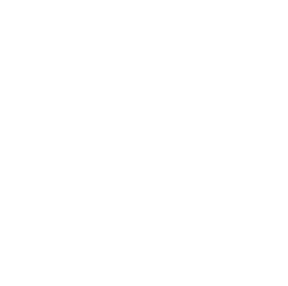

Refrigerator Category H1/2025: 94% Growth Across E-commerce Platforms

According to YouNet ECI data, in the first half of 2025, the Refrigerator category recorded a +94% increase in total GMV across major E-commerce platforms – Shopee, Lazada, and Tiki. Notably, Shopee alone saw an impressive +165% year-over-year growth, underscoring the platform’s growing dominance in high-value appliance sales.

More specifically, the Top 5 refrigerator brands, as ranked by YouNet ECI, all witnessed significant GMV surges in the first six months of 2025 compared to the same period last year – across all stores generating revenue for each brand on Shopee, Lazada, and Tiki.

This growth trend comes as a surprise, given that large home appliances have traditionally been considered challenging to sell online due to high logistics costs and consumer trust barriers.

However, as previously forecasted in the Vietnam E-commerce Intelligence 2025 Report by YouNet ECI and YouNet Media, the Home Appliance category on E-commerce is expected to grow +116% from 2023 to 2028.

According to YouNet ECI, the foundation of this growth lies in the continuous improvements from both E-commerce platforms and brands in enhancing online shopping experiences – particularly in delivery reliability, digital payment options, and after-sales warranty support.

With this major market shift underway, the question now is: Which brands are successfully adapting and leading the transformation – and which are falling behind?

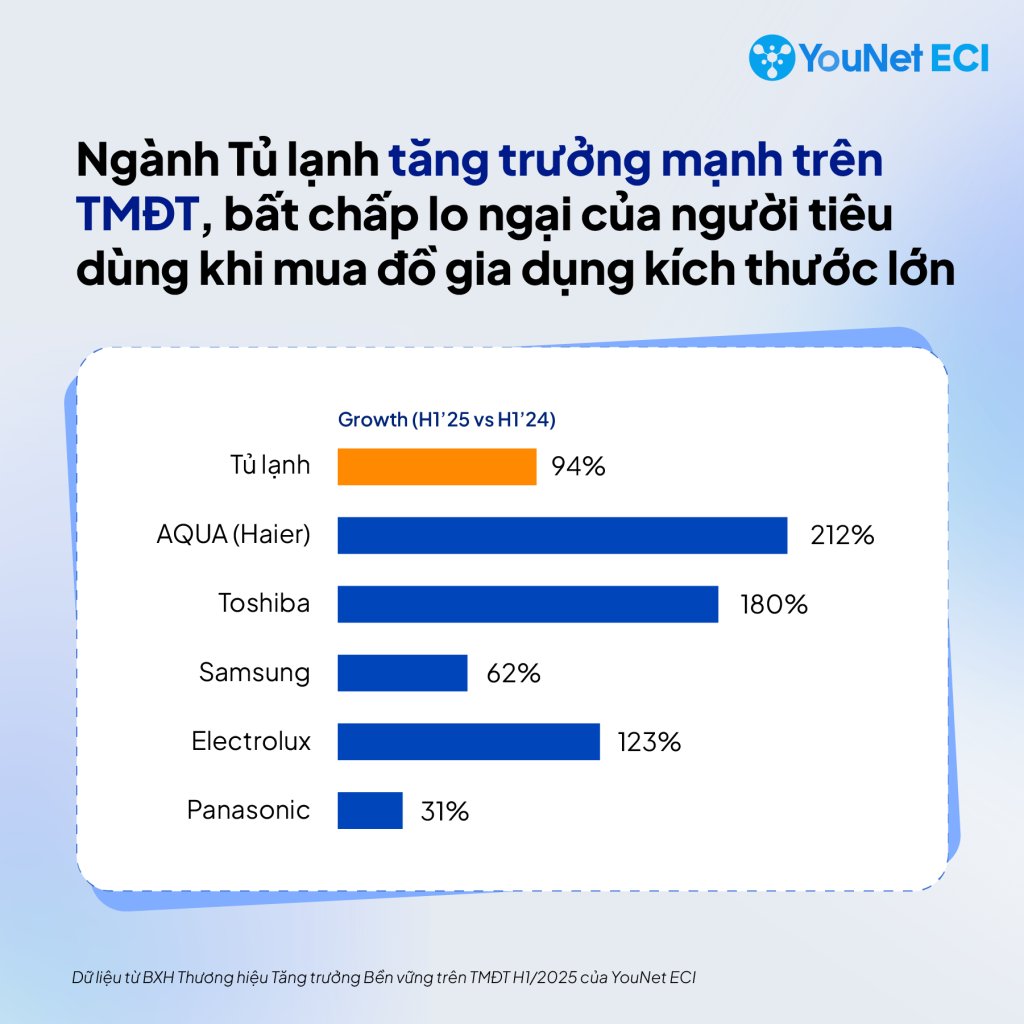

AQUA (Haier) Tops the Ranking: Success Driven by a “Compact Lifestyle” Product Strategy

Appearing in YouNet ECI’s Sustainable Growth Ranking, AQUA (Haier) leads the E-commerce refrigerator category with an impressive 67 points, far ahead of major competitors such as Toshiba (52 points), Samsung (47 points), and Electrolux (46 points).

Capturing 24.4% of the total E-commerce market share and generating nearly VND 43 billion in GMV in H1/2025, AQUA achieved the fastest revenue growth rate in the entire category. Beyond its dominant Performance score, the brand’s strong Variant index – representing product diversity and revenue contribution per model – is another key advantage.

Among more than 80 refrigerator variants contributing to 80% of total industry GMV, AQUA alone owns 18 models, highlighting its ability to build a broad yet competitive product portfolio across E-commerce platforms.

A closer look at AQUA’s top 5 best-selling refrigerator lines reveals that the brand’s growth is concentrated in the small-capacity segment (<150 liters) — in contrast to competitors like Toshiba, Samsung, Electrolux, and Panasonic, which mainly focus on medium to large-capacity models (200–600 liters).

Small-capacity refrigerators perfectly meet the needs of single or two-person households, often young consumers, with affordable prices (VND 3–5 million), compact design, and space-saving convenience. Meanwhile, larger models cater to multi-member households with premium feature expectations, typically priced above VND 7 million. Small-capacity units also hold an advantage in E-commerce logistics, thanks to lower shipping costs.

By strategically targeting this young, digital-native audience, AQUA has effectively differentiated itself from other competitors, securing a strong and sustainable competitive edge in the E-commerce refrigerator market.

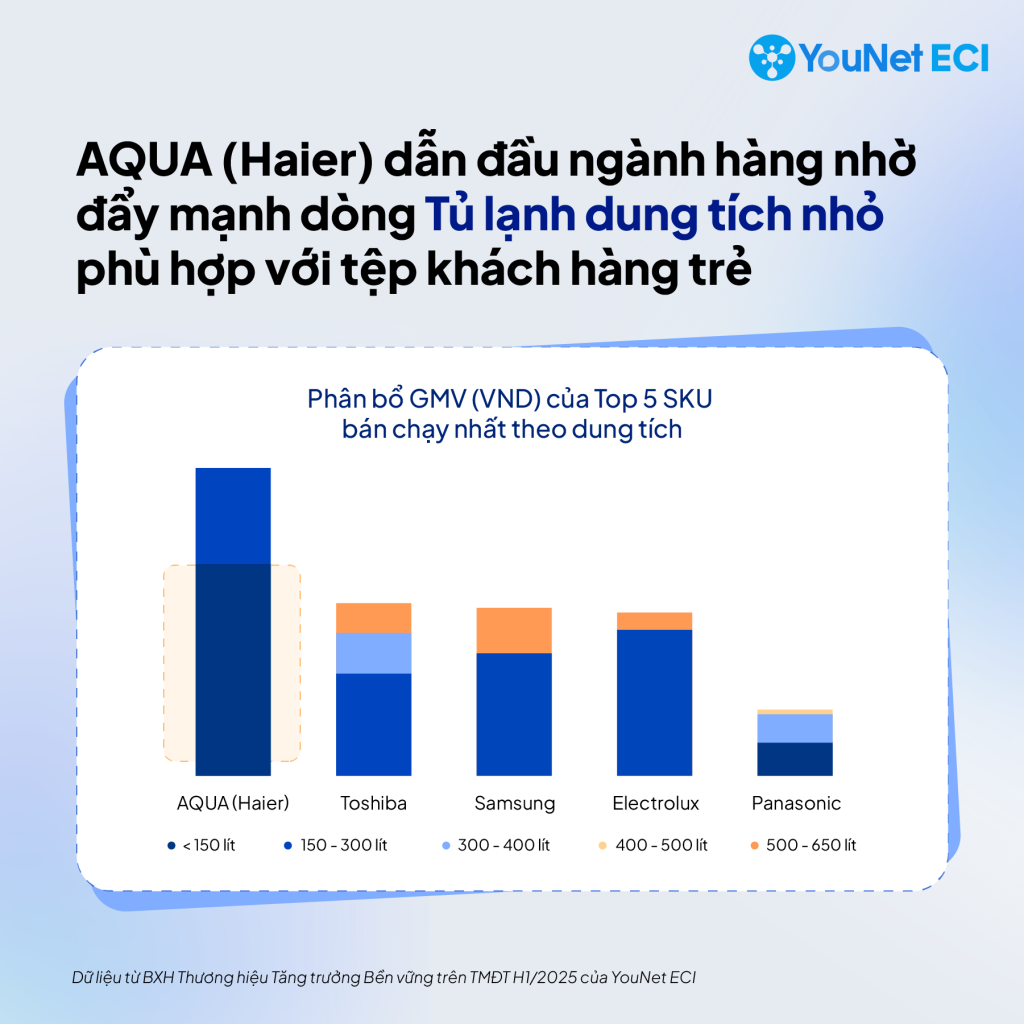

Sustainable Growth on E-commerce: Revenue and Operations Must Go Hand in Hand

In YouNet ECI’s E-commerce Sustainable Growth Ranking, overall performance is assessed across two key dimensions: Performance (Growth) and Operations (Operational Excellence). The Operations dimension is a composite index derived from three components – Shop, Variant, and Price.

The lower half of YouNet ECI’s Refrigerator category ranking reveals an important insight: while many refrigerator brands are achieving sales growth on E-commerce platforms, their long-term sustainability remains weak due to operational inefficiencies.

For instance, Casper ranks second in Performance (29 points, just behind AQUA) but sits near the bottom in Operations. Similarly, Funiki ranks third in Performance, yet comes last in operational capability.

In contrast, LG presents the opposite scenario – strong in Operations but lagging in Performance (only 6 points), resulting in an overall drop in ranking.

According to YouNet ECI data, despite LG’s wide product portfolio spanning multiple price segments, most of its products are positioned in the higher-end range, which makes them less accessible to E-commerce consumers. In fact, 4 out of LG’s 5 best-selling refrigerator models are priced between VND 17–37 million, significantly above the average online spending threshold.

As a result, YouNet ECI recommends that refrigerator brands – and home appliance brands in general – focus on expanding product offerings in the mass-market segment, which aligns better with current consumer purchasing power on E-commerce platforms.

“Diversify and De-risk”: The Key to Sustaining Growth in the New E-commerce Landscape

In the E-commerce world, short-term revenue performance alone is not enough to ensure a brand’s ability to maintain and achieve sustainable growth amid market fluctuations. With this vision, YouNet ECI’s Sustainable Growth Brand Ranking serves as the most comprehensive and unique benchmark currently available, evaluating E-commerce performance across two critical dimensions:

- Growth: Market share and revenue performance.

- Operations: Distribution channels, product assortment, and pricing range.

“At YouNet ECI, we guide our enterprise clients to adopt a ‘diversify and de-risk’ strategy – a core principle for long-term E-commerce operations. This four-index framework serves as the foundation for brands to assess their revenue sustainability,” said Mr. Nguyen Phuong Lam, Market Analysis Director at YouNet ECI.

Read more: Top 40 Sustainable Growth Brands on E-commerce H1/2025

About YouNet ECI

YouNet ECI, a member of YouNet Group, is a trusted data-driven consulting firm specializing in E-commerce growth strategies for consumer brands.

The company provides accurate, in-depth, and comprehensive market intelligence and analytics solutions to help brands gain a holistic view of their category, monitor brand performance, and optimize product portfolios across major E-commerce platforms.